Is a Career in Massage Therapy Your Path? Take the Free Quiz

A Lack of Clarity in the Ballot Presentation of Missouri Constitutional Amendment #4 Could Trick Massage Therapists in to Voting for Sales Tax on Massage Therapy Services.

When you see this on the ballot, however, you can easily get confused. The ballot looks like this:

Why HAC Recommends A "Yes" Vote On Amendment #4:

HAC is not prepared to say that the way the proposal is presented on the ballot is intentionally tricky, but it most certainly can be misleading. We advise voters to read all ballot initiatives very carefully in every case, but especially here. In this case "yes" means "no" to sales tax on professional services.

|

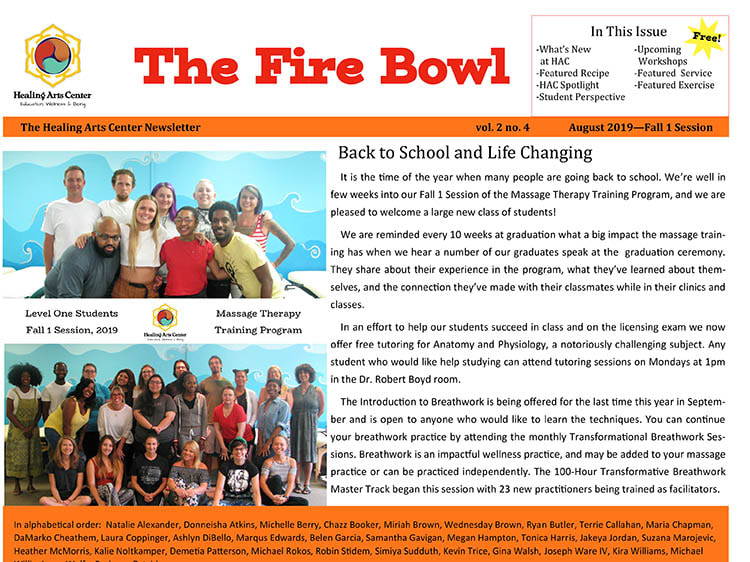

Healing Arts Center News

Keep up with what's happening at the Healing Arts Center.

Follow us on Social Media:Read the Fire Bowl School Newsletter:

Categories

All

|

*The Healing Arts Center is proudly accredited by the Accrediting Commission of Career Schools and Colleges (ACCSC) for the 600-hour massage therapy training certificate only. ACCSC does not accredit individual Master Track courses or CEU offerings separately for this or any institution.

Follow Us Online:

© Copyright, The Center For the Healing Arts, LLC, 2020